Getting a joint mortgage with someone with bad credit

These are just some of the challenges you may face when buying someone out of a joint mortgage. Average credit scores range from 580 to 669.

Getting A Joint Mortgage When An Applicant Has Bad Credit Haysto

Terms and conditions apply.

. However while some personal loans. Of course this. Variable APRs range from 2224 3174.

Good credit scores begin at 670. CreditLoan is a trusted online lending network that offers personal loan options ranging from 250 to 5000 for folks with less-than-perfect credit scores. There are a lot of Bad Credit Car Dealerships Houston.

Having a poor credit history might not automatically rule out your chances of getting a mortgage but it certainly runs the risk of scuppering them. To give yourself the best chance possible of acceptance take the time before you apply for a mortgage to get your credit report into good shape. Earn unlimited 2X miles on every purchase every day.

Read on to find out how to overcome these challenges. Going to a bad credit car dealership is a great option for those who have poor. You can find an SBA loan program such as the one for startups that is geared to companies with bad credit.

Get a business credit card. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The Difference Between Authorized Users and Joint Accountholders.

The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision. Loans guaranteed by the SBA as small as 500 are available. Avants minimum FICO credit score is 580 the lowest among the four lenders on this page that disclose their credit score requirements.

Getting a Mortgage with a Debt Management Plan DMP. If youre looking to remortgage get a homemovers mortgage or remove yourself from a joint fixed-rate agreement following a separation a broker can help you through the process and potentially. You could opt for a joint current account for everyday banking and payments including all your bills and income.

Senate race border wall gets a makeover. A bad credit score instantly makes you a high-risk borrower. Heres how much you could save by transferring a credit card balance of 5525 to one of our best balance transfer credit cards based on the following conditions.

Politics-Govt Just in time for US. If for example you have three applicants on a mortgage and one of them has had credit issues. If someone doesnt have a lengthy credit history or has poor credit history your positive account management might help.

Cheapest Bad Credit Financing Dealerships Near Me In Houston Houston Direct Auto Offers the Best Bad Credit Car Loans in Houston TX. If one has bad credit and the other clean the bad credit is still taken into account by the lender. 0 Annual Fee.

Our Experts pick 5 best lenders for you to apply with if you have a bad credit history. A joint accountholder is someone who opened the account with you. We welcome your comments about this publication and your suggestions for future editions.

Earn a credit limit increase in as little as 6 months. 300 5000 credit limits. If youve been trying to find a mortgage broker for bad credit speak to us and let Simply Adverse show you some of the best bad credit mortgage rates.

Find a mortgage broker. Its important to know that an authorized user is not the same as a joint accountholder. Applying for an online personal loan with CreditLoan is free quick and easy.

If the main borrower is applying for a bad credit mortgage however adding a joint borrower is unlikely to help just to overcome credit issues. Generally mortgage applicants are as quick as the slowest wheel ie. By using a mortgage broker you can avoid paying any unnecessary fees and increase your chances of achieving your plans.

Purchasing a car with bad credit may seem impossible but its really not. After youve successfully completed your full mortgage application and been through the various credit checks youll then receive your official mortgage offer. NW IR-6526 Washington DC 20224.

Bad Credit Mortgages. Alternatively opening a savings account with someone else can let you put money away for lifes big expenses. This way you can keep getting interest on the lump sum while getting a higher rate on the money you pay in to the regular saver.

If your bad credit is preventing you from getting a business loan apply for a basic business credit card. If youre remortgaging to a new agreement with a person who has bad credit keep in mind that this could affect the overall strength of your application and this could mean higher rates or needing to put down more deposit. Bad credit mortgages with multiple applicants.

After 12 monthly payments the full amount will be in the regular saver. Credit bureau Experian doesnt use the term bad credit but it does consider any score below 580 to be very poor credit. Let our team of specialist bad credit mortgage brokers help you find the best mortgages for bad credit UK-wide.

Workers say pay isnt keeping up with inflation More than half of employees who recently got raises said they werent high enough to cover rising expenses survey finds. Joint current accounts and joint savings accounts have some key differences to be aware of. Impact on bad credit borrowers.

By paying your credit card bills on time. A mortgage in principle is useful in getting you started on your search for buying a home but youll need to officially apply for a mortgage once youve had an offer accepted. Enjoy a one-time bonus of 75000 miles once you spend 4000 on purchases within 3 months from account opening equal to 750 in travel.

Potential lenders will review your loan request and if you meet their lending criteria will make an offer. Dont get stressed out wondering can you get a mortgage with bad credit. If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own.

If youre adding somebody with bad credit to your mortgage seeking advice from a mortgage broker is recommended. You can then move the whole lot to the top payer at the time and start the process again with a new regular saver provided theyre still around. If you have bad or poor credit as defined by FICO a score of 350 to 579 you wont be able to qualify for a personal loan unless you apply with a co-signer.

If for instance if you want a JBSP mortgage with someone who is 60 the lenders policy may be to cap the term to 5 years meaning the mortgage payments could be more expensive.

How To Get A Mortgage With Bad Credit Credit Com

Pin On Financial Tips

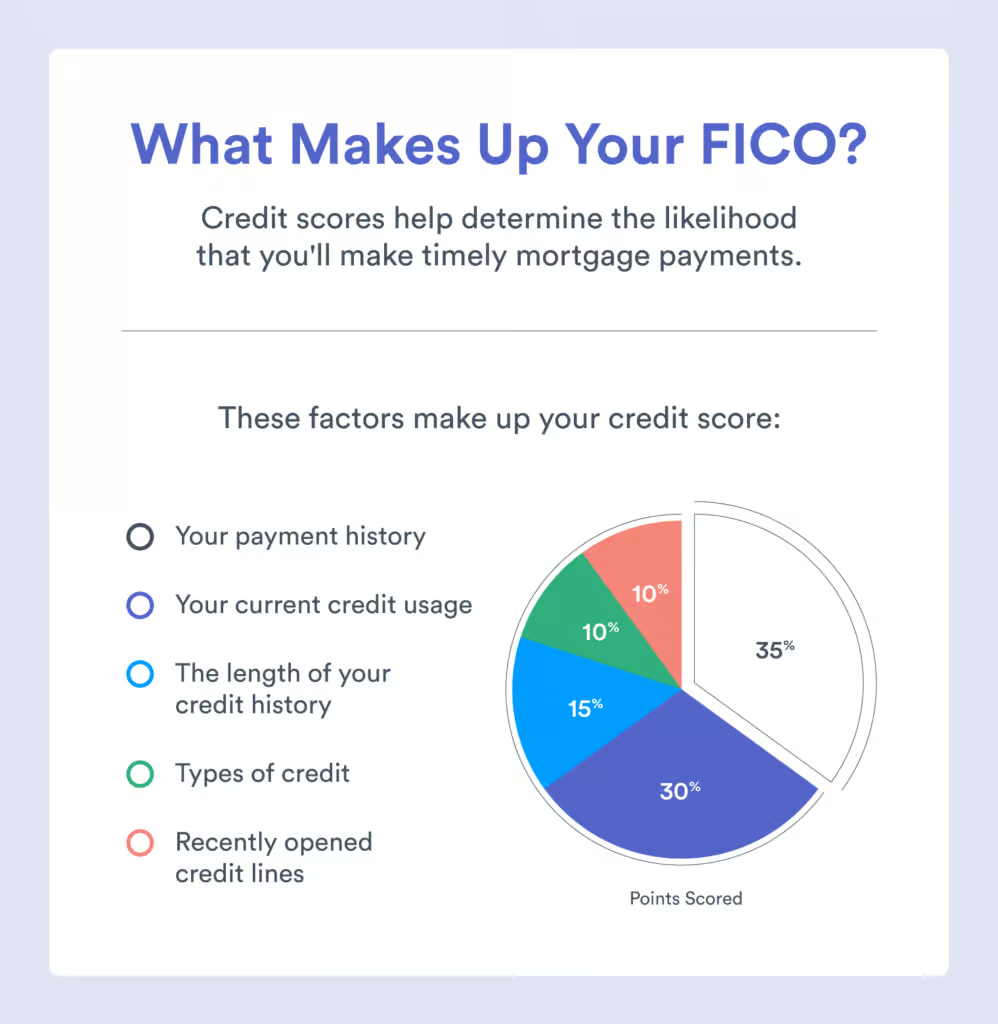

What Credit Score Do You Need To Buy A House In 2022

How To Get A Mortgage With Bad Credit Credit Com

Getting A Joint Mortgage When An Applicant Has Bad Credit Haysto

Minimum Credit Score For Mortgage September 2022

What Is Credit Rating Visual Ly Credit Repair Credit Repair Companies Improve Your Credit Score

When Is The Best Time To Apply For A Mortgage Assurance Financial

Minimum Credit Score For Mortgage September 2022

The Fastest Ways To Build Credit Infographic Build Credit Ways To Build Credit Paying Off Credit Cards

What Credit Score Do You Need To Buy A House In 2022 Ally

Mortgages Get Preapproved For A Home Loan Navy Federal Credit Union

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

Minimum Credit Score For Mortgage September 2022

Home Loans For People With Bad Credit Home Maintenance Home Buying Home Loans

Mortgage Lenders Are Loosening Credit Standards Rapidly Mortgage Lenders Mortgage Loan Originator Mortgage Interest Rates

Komentar

Posting Komentar